Today was an exciting day in the cryptocurrency market. I made 12 trades with closes in profits ranging from 0.89% to 12.18%. While these numbers may seem small, when you multiply them day after day, the results are powerful.

In this blog you will not find unrealistic “get rich overnight” promises. Here I share practical strategies, real results and, most importantly, the truth about trading: there are risks, but also great opportunities.

My Results of the Day

Here’s a breakdown of the profits from my trades today, all made on Pionex:

Trade 1: +0.89%.

Trade 2: +5.33%.

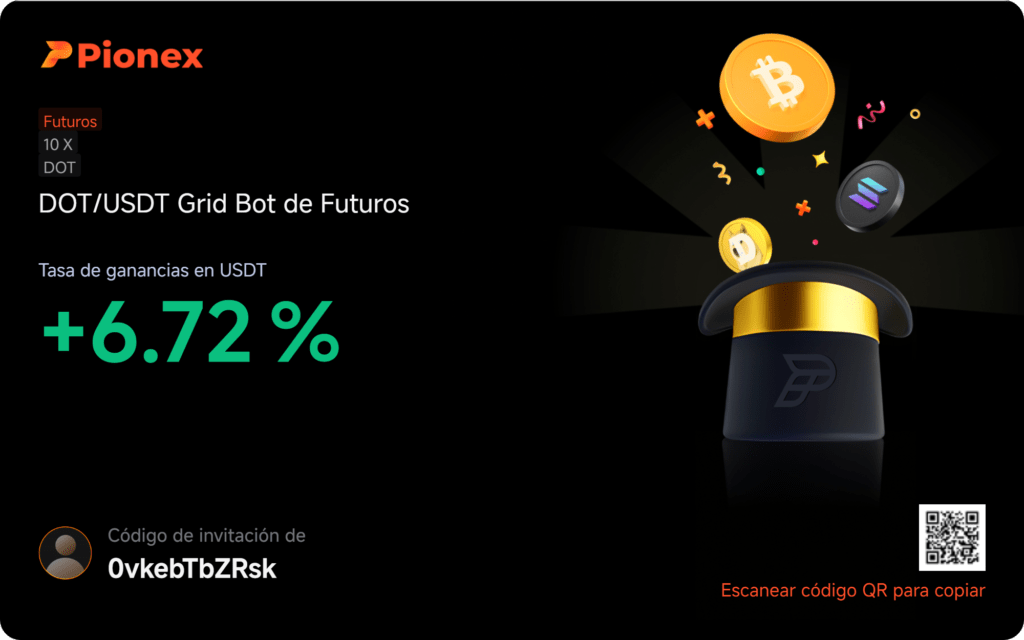

Trade 3: +6.72%.

Trade 4: +7.46%.

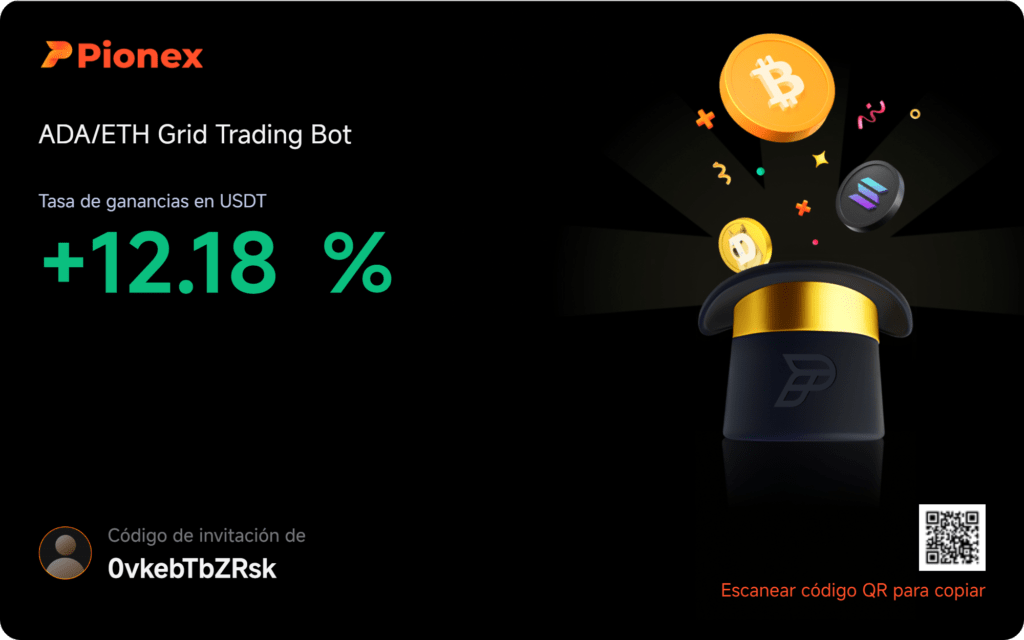

Trade 5: +12.18%.

These trades are not luck. They are the result of applying clear strategies, managing risk and respecting technical analysis.

The Strategies I Use for Trading

Here are three keys that helped me to obtain these gains:

- Identifying Trends with Technical Indicators.

I use tools like the RSI and EMAs to identify entry points. For example, when the RSI is oversold and the price breaks a key resistance, it is a buy signal that often pays off. - Risk Management: I never risk more than 10-20% of my total capital on a single trade. This ensures that even if I have negative days, my account will not be seriously affected.

- Asset Diversification: Today I traded several cryptocurrency pairs, including ADA/ETH in SPOT and DOT/USDT at 10X FUTURES, this last pair was quite volatile and helped me maximize my income. Trading more than one pair helps me minimize dependence on a single market.

Why I’m Sharing This

This blog is not just a record of my trades. It’s a space to learn together, exchange ideas and, in the future, build something bigger: GainsPool.

My vision is to create a transparent pool, where you can participate and share the results of our trades, knowing the risks and opportunities from day one.

What’s Next: Upcoming Posts and More Strategies

If this post interested you, here’s a preview of what I’ll be sharing next:

- Complete technical analysis strategy that helped me gain over 12.18% today.

- How to diversify your cryptocurrency portfolio to reduce risk.

- Why discipline and emotion management are key in trading.

What would you like to learn?

Now it’s your turn:

What questions do you have about trading or cryptocurrencies?

What strategies would you like to understand in detail?

Leave me your comments, and I’ll answer them in the next posts.

Join the Community

Don’t forget to follow this blog so you don’t miss any details about how to maximize your results in the cryptocurrency market, this is just the beginning!